29-Nov-2024

Beyond the Basics: Unlocking opportunities in private credit

The latest Scarcity Partners livestream offered a deep dive into the private credit landscape, with key insights from Ryan Donnar, Managing Partner at Dinimus.

Privity Credit is proud to have contributed to the Alternative Investment Management Association’s (AIMA) landmark report, Private Credit in Asia 2.0. The report captures the momentum behind the Asia-Pacific private credit market, a region experiencing one of the fastest transitions from niche lending to a mainstream asset class.

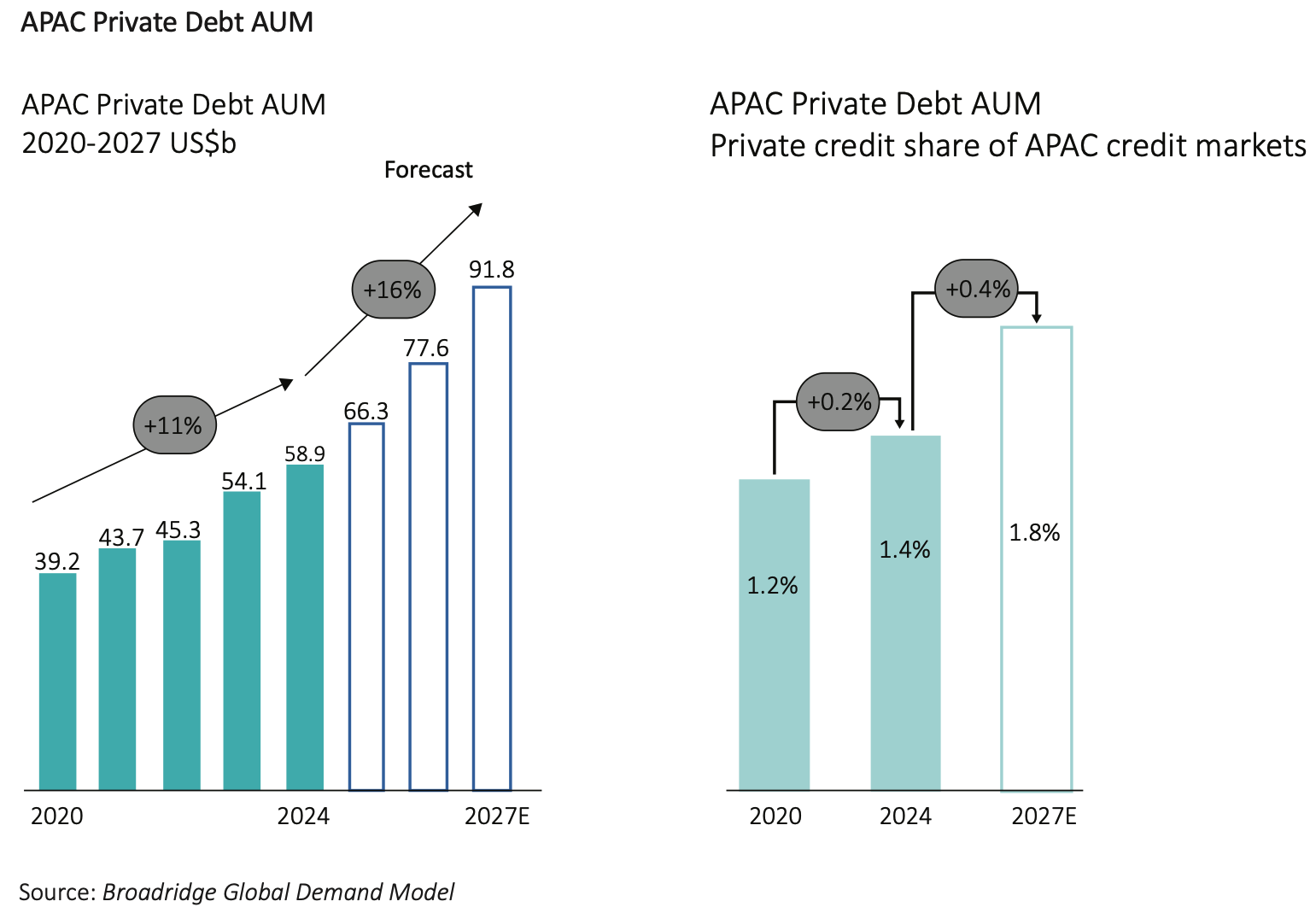

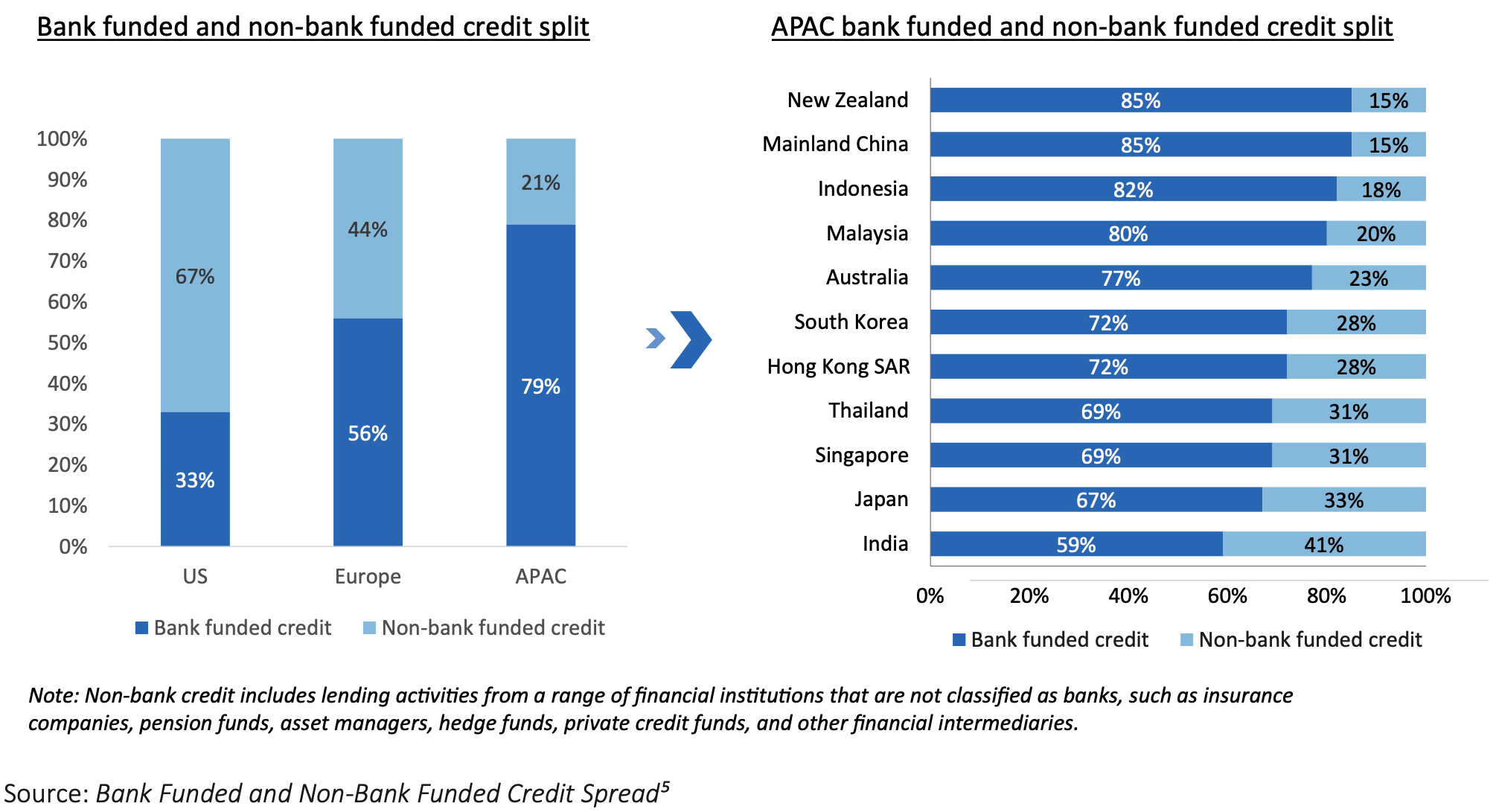

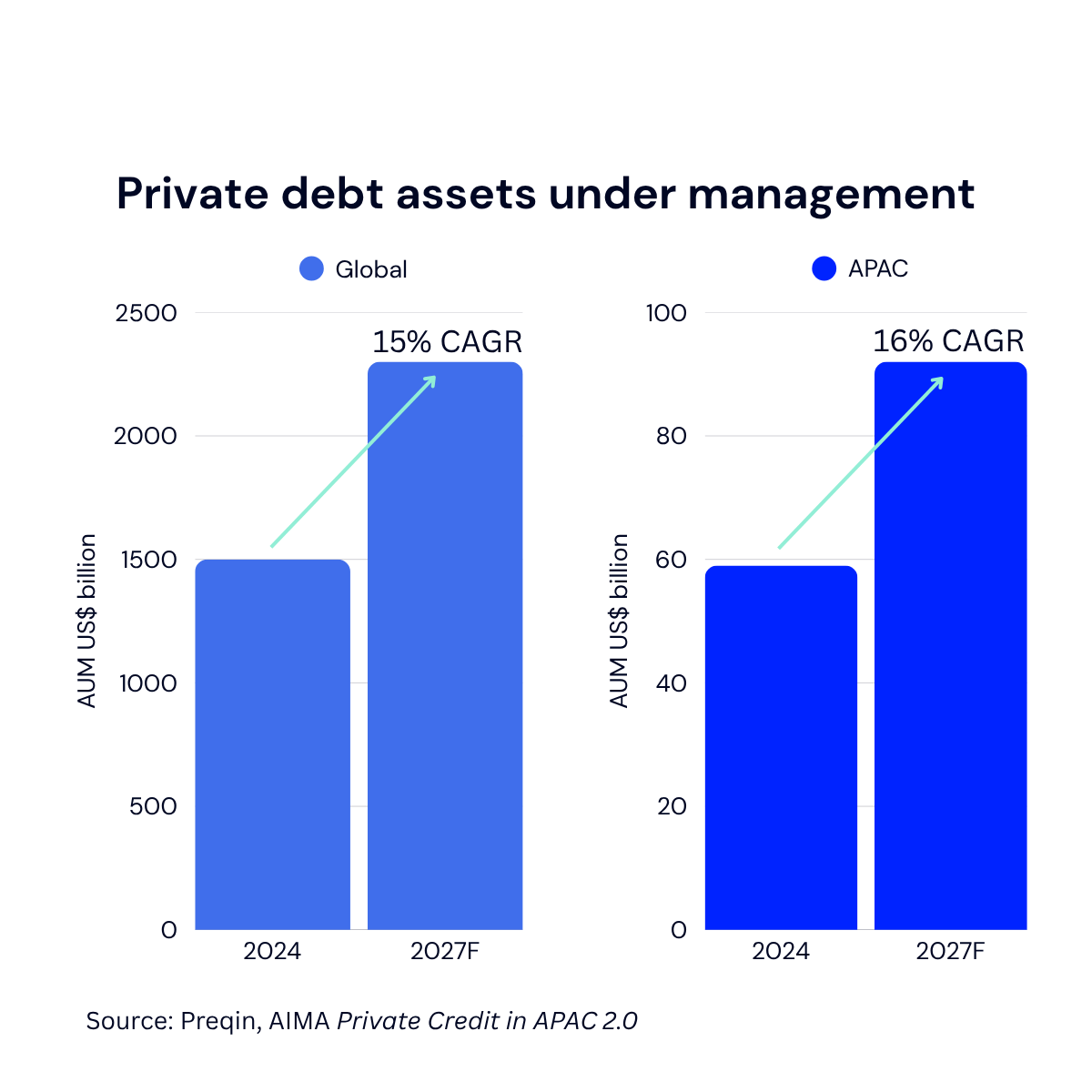

With private credit assets under management (AUM) projected to grow from US$59 billion in 2024 (of which Australia is US$3.8 billion) to US$92 billion by 2027, representing a 16% compound annual growth rate, the region is entering a phase of sustained expansion and structural maturity. For Australian investors, these findings highlight four insights shaping both domestic and regional investment opportunities.

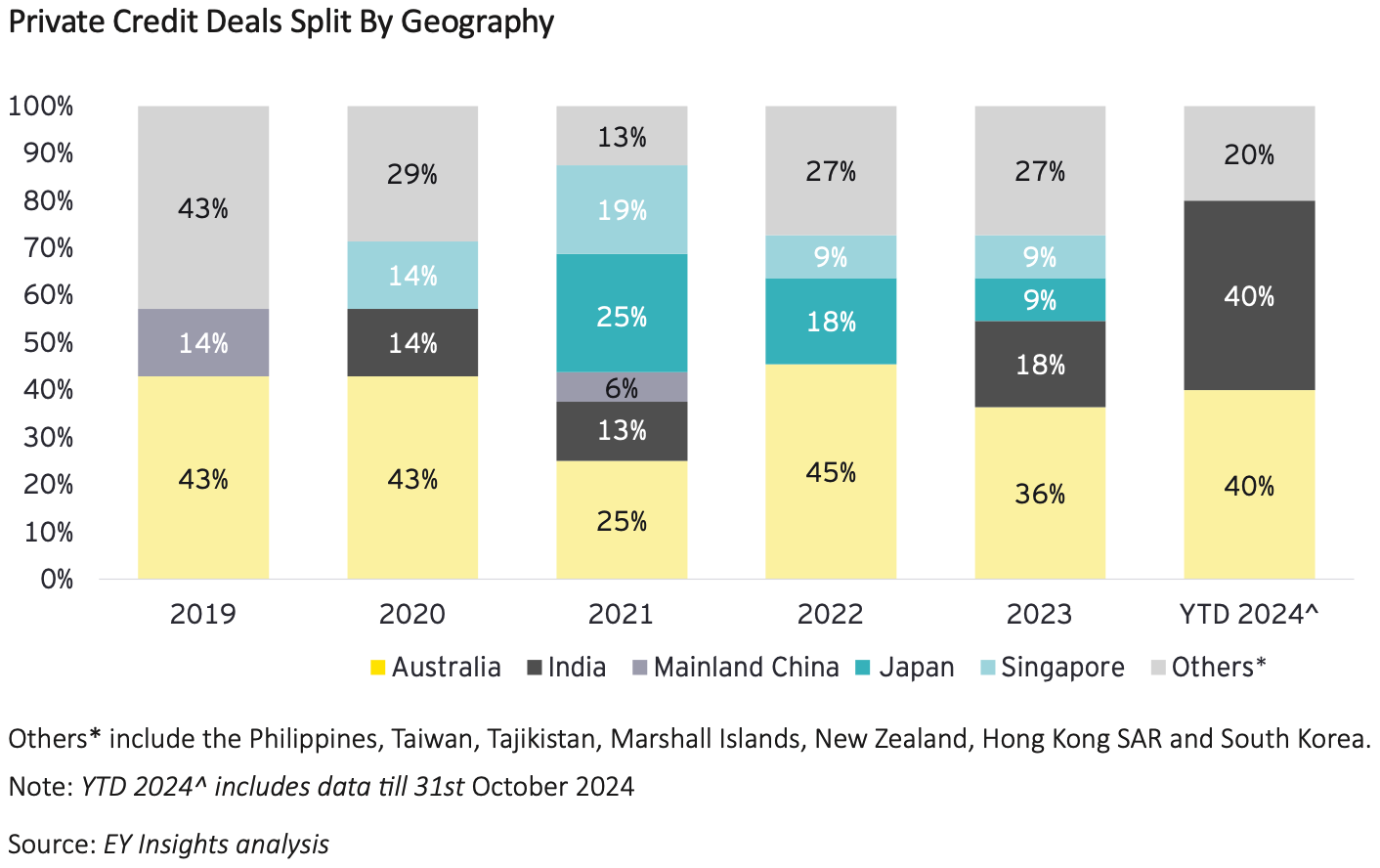

Australia stands out within the Asia-Pacific region as one of the most developed and stable private credit markets. According to the AIMA report, private credit in Australia has consistently outpaced overall business debt growth by around two percentage points, extending a multi-year trend of relative resilience.

This reflects strong underlying fundamentals: a robust legal framework, prudent lending standards and investor appetite for yield-driven, collateralised strategies. Even as traditional credit conditions tighten, private credit in Australia continues to expand supported by domestic managers, such as Privity Credit, that now account for 68% of market activity.

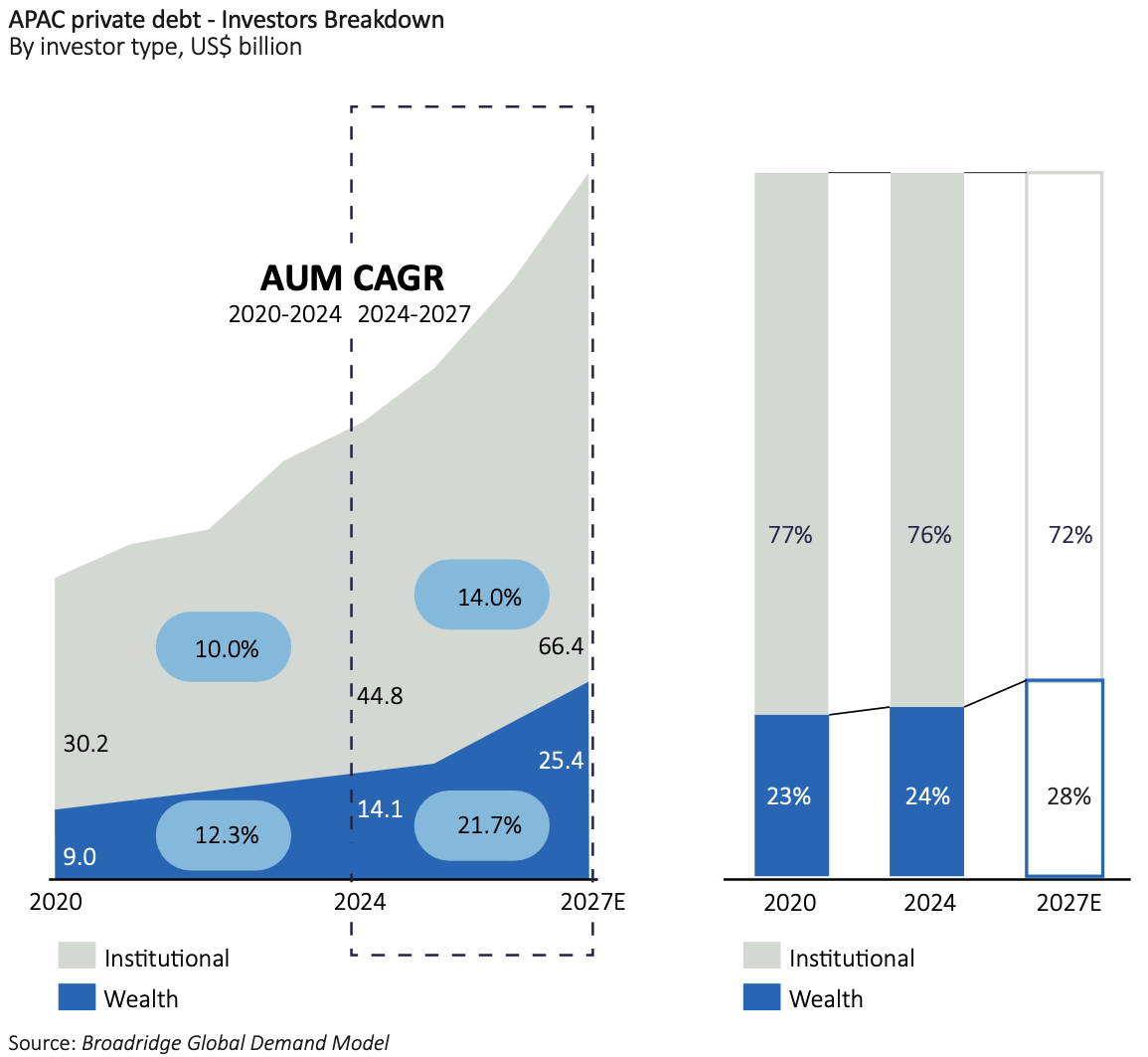

Across Asia-Pacific, institutional allocators and private wealth investors are fuelling new inflows into private credit. The AIMA report forecasts that wealth investors will represent 28% of total AUM by 2027, up from 23% in 2020 underscoring the asset class’s evolution from institutional niche to mainstream investment option.

For Australian investors, this trend signals growing accessibility to high quality private credit vehicles and a more sophisticated local market structure. The increasing participation of family offices, superannuation funds and high-net-worth investors reflects confidence in private credit’s ability to generate stable returns in a higher rate environment. Additionally, we are seeing financial advisers and their clients increasingly interested in private credit when looking for income, yield and low correlation with public markets.

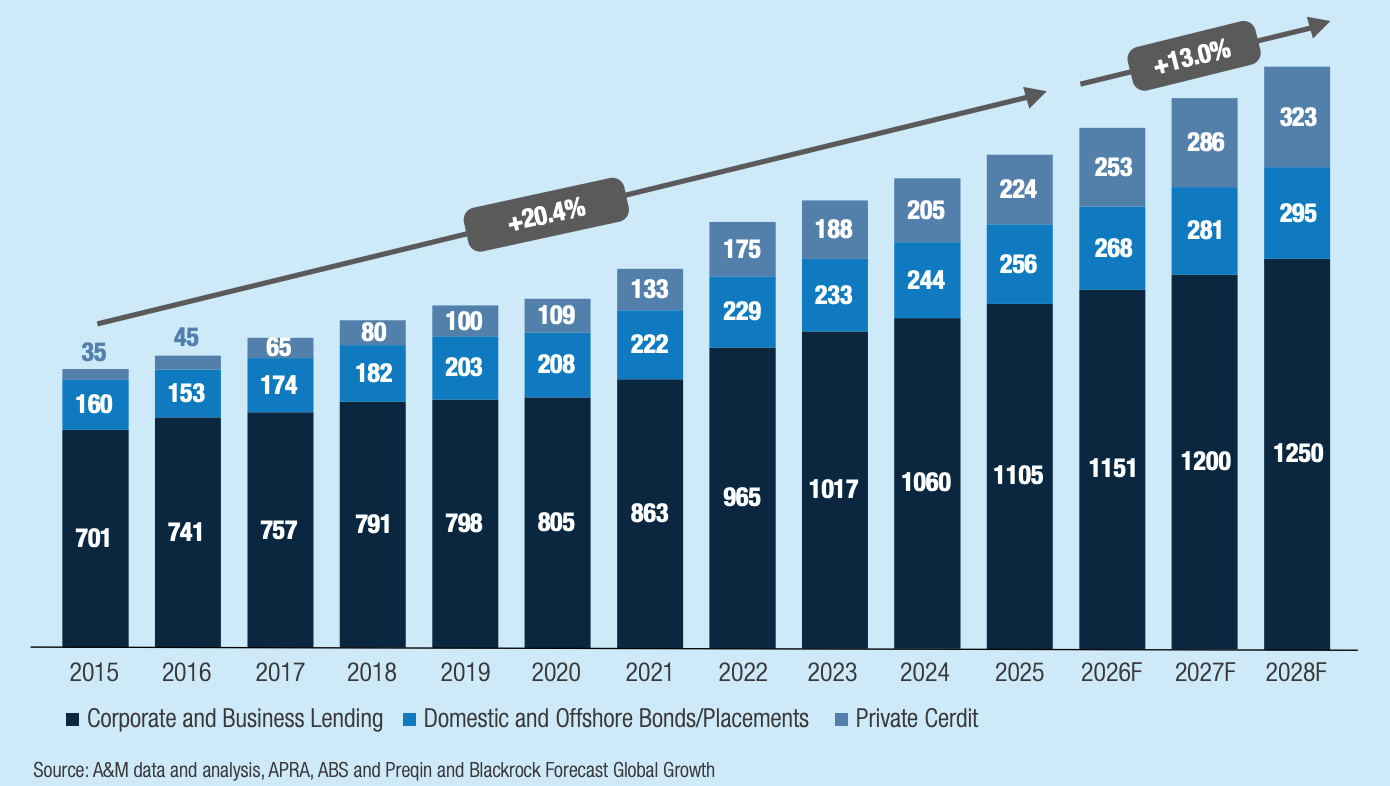

A defining feature of Asia-Pacific private credit is its SME and mid-market focus. In Australia, as part of long-term structural shift, banks continue to retreat from smaller and mid-sized corporate lending due to higher capital and operating costs which make it more efficient and profitable for them to offer standardised products, not bespoke solutions.

This has opened a US$2.5 trillion regional financing gap across the region, much of it concentrated in SMEs.

Private credit managers are stepping in to fill this void with bespoke, relationship-driven lending models, a space where Privity Credit has long focused its efforts. As the report notes:

“Our edge is customisation of capital, we sit down to understand what the borrowers need, then we offer. We are not selling standardised products.”

— Privity Credit

For investors, this segment provides a compelling balance of yield, risk management, and economic contribution given private credit directly supports business growth and employment while delivering portfolio diversification.

The AIMA report confirms that private credit is no longer a peripheral strategy in Asia — it is rapidly becoming a core allocation. The projected US$92 billion AUM by 2027 reflects both investor conviction and the market’s increasing maturity.

Australia’s established ecosystem — with creditor-friendly regulation, experienced managers and strong investor demand — positions it at the forefront of this evolution. For domestic investors, this means the opportunity to gain exposure to an asset class that combines consistent yield, downside protection and uncorrelated performance within a robust local framework.

Conclusion

The Private Credit in Asia 2.0 report underscores what many Australian investors already recognise: private credit is entering a new phase of maturity and opportunity.

As both a contributor to the report and an active participant in Australia’s private credit landscape, Privity Credit continues to champion a disciplined, capital preservation-focused approach, providing investors with access to differentiated opportunities grounded in real-economy value creation.