29-Nov-2024

Beyond the Basics: Unlocking opportunities in private credit

The latest Scarcity Partners livestream offered a deep dive into the private credit landscape, with key insights from Ryan Donnar, Managing Partner at Dinimus.

Privity Credit recently published an in-depth white paper on the outlook for private credit. It provides a global context for Australian investors to better understand the forces at play. You can download the full white paper using the link below.

Follows are some key insights from the paper.

Executive Summary

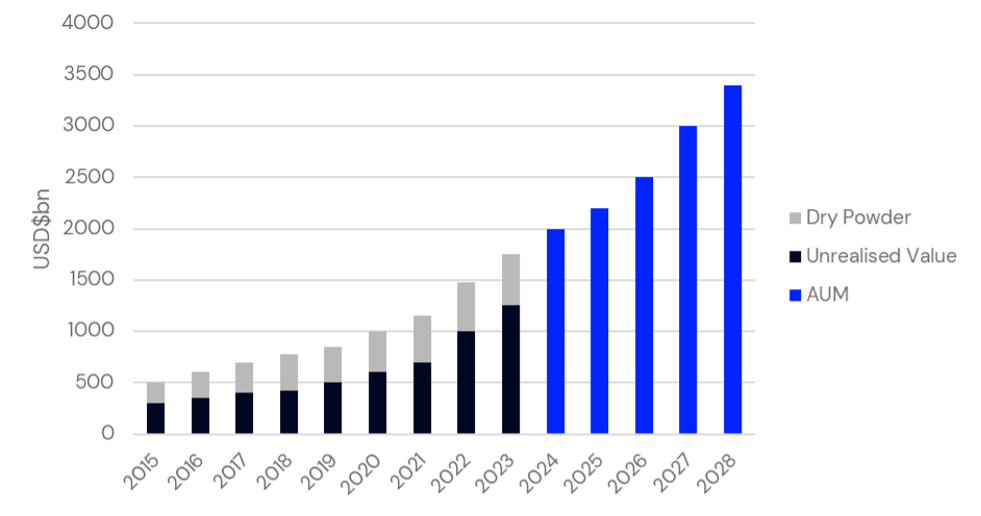

Privity Credit expects the growth of private credit to continue, reaching circa US$3.5 trillion over the coming years driven by further acceptance of its importance in investors’ portfolios due to its stable cash flow and lower volatility.

Private credit in Australia presents a particularly strong growth opportunity, driven by structural shifts in bank lending, regulatory changes and increased demand for flexible financing. Despite increasing green shoots, Privity Credit continues to structure transactions conservatively, ensuring resilience across economic cycles.

In our opinion, private credit managers with diversified portfolios and through the cycle experience focusing on Australia’s mid-cap sector will be well-positioned to capture opportunities. Australian banks account for 70–85% of the total credit market, compared to 30% in the US and 50-60% in European markets, suggesting Australian private credit lenders have a long runway domestically.

The market currently values the future earnings of private credit lenders at a higher P/E multiple than banks, reinforcing long-term potential for investors in Australian private credit.

We expect performance dispersion among private credit managers, with the most successful firms demonstrating:

The Rise of Private Credit

Globally private credit has earned its way into portfolio allocations as a sub-asset class producing attractive returns per unit of risk. As of June 2024, it accounted for 0.9% of global market portfolios and 11.7% of the global alternative allocation.

Australia’s Private Credit Landscape

Private credit in Australia continues to benefit from trends that have been entrenched in the US and European markets for the last two decades. However, Australia’s private credit sector is still in a high-growth phase, supported by:

Unlike global markets where private credit has matured, Australian banks’ higher market share means the sector has substantial expansion potential.

Australia’s 2025 Outlook for Private Credit

We expect favourable outcomes for Australian private credit, driven by several prevailing tailwinds:

1. Expanding Market Size

2. Regulatory and Banking Trends

3. Private Credit’s Role in Australian Corporate Lending

Private Credit in the Mid-Market – Australia’s Mid-Cap Lending Opportunity

Bank lending to mid-sized businesses has declined leading to strong demand for private credit.

Non-discretionary sectors (healthcare, food, logistics) have been able to absorb inflationary costs making them attractive lending opportunities.

The macro landscape, though weaker, is not as severe as during the GFC – the most recent major trough in the credit cycle. This is true for both global markets as well as Australian onshore markets. [Insert Exhibit 16]

Geopolitical Forces & Private Credit – Australia’s Position in a Changing Trade Environment

Trade uncertainty, particularly US tariffs, will impact global supply chains, indirectly affecting Australian businesses.

Australian businesses face competition from potential dumping from global exporters as well as reduced inventory turnovers of their global clients. Private lenders need to stress-test borrower exposure to tariff-driven price pressures.

Inflation & Interest Rate Trajectory

Higher-for-longer interest rates have already benefited private lenders, with floating-rate lending structures driving yield expansion. What remains to be seen is whether tariff induced inflation will move the narrative from “higher for longer” or “interest rate curves flattening” to “has the headline interest rate really peaked”?

Read the full white paper by clicking the link below.