1

How we think

At Privity Credit, we’d rather be thought of as dependable than flashy.

Which isn’t to be confused with us targeting superior returns for our investors by offering tailored and well-structured loans to quality Australian and New Zealand corporates who are looking for growth capital.

We believe that successful private credit investing hinges on rigorous credit analysis, diversity of borrower type and industry sector and a disciplined approach to risk management.

This requires an experienced team that has been tested through market cycles and has the expertise to manage through good times and bad. By actively managing our portfolios and tailoring solutions to meet the unique needs of each borrower, we aim to deliver consistent returns for our investors.

Privity Credit’s commitment to meticulous due diligence, conservative deal structuring and active management of our loans ensures capital protection while providing attractive yield opportunities.

2

Track record

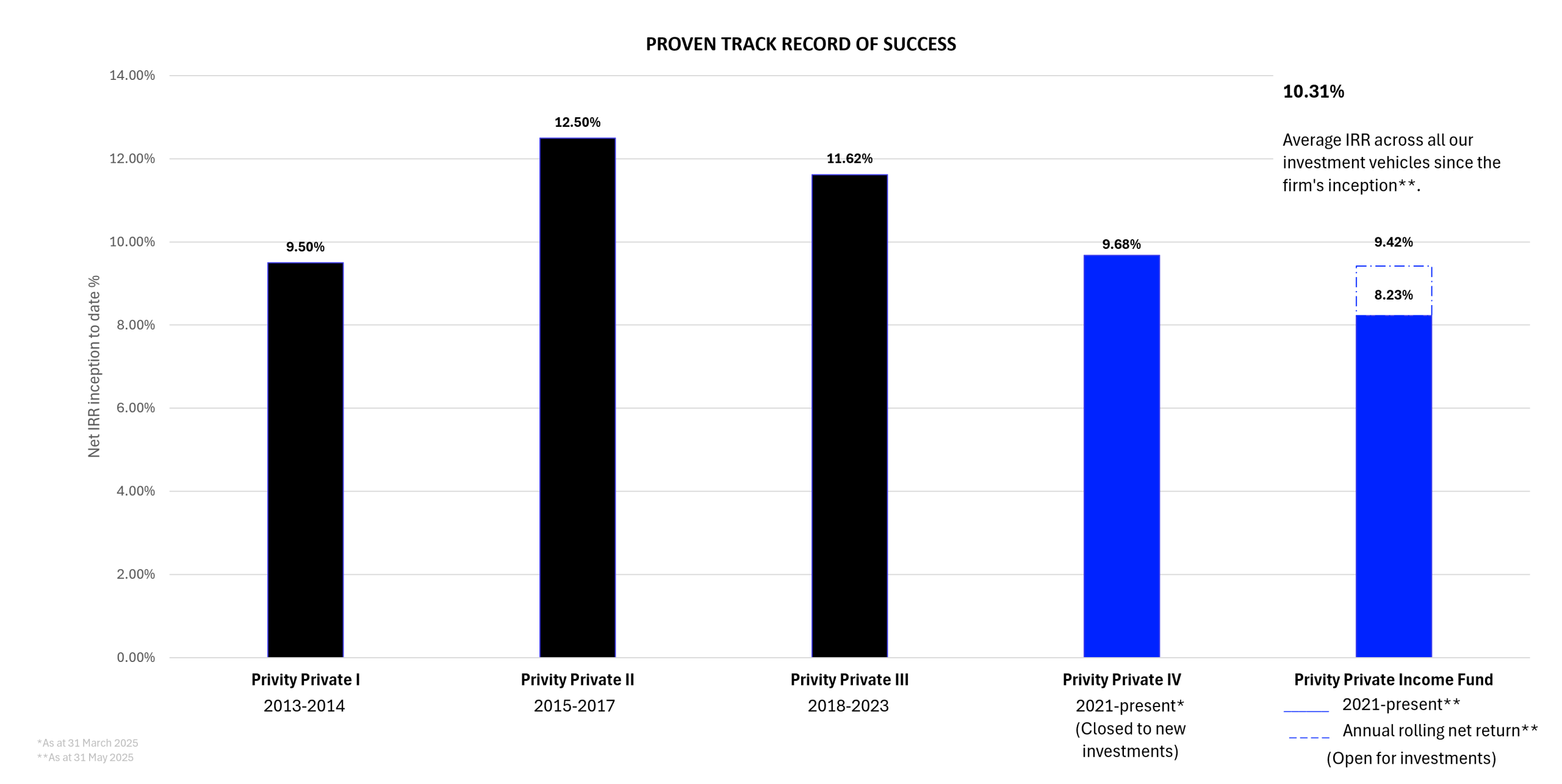

Proven track record of success

Since the launch of our first fund in 2013, Privity Credit has gone on to produce outstanding returns for our investors.

As part of the firm’s rebrand, we have changed our funds’ names as follows: Privity Private I (formerly DCF Private Debt I), Privity Private II (formerly DCF Private Debt II), Privity Private III (formerly DCF Private Debt III), Privity Private IV (formerly DCF Private Debt IV), and Privity Private Income Fund (formerly DCF Private Debt IV-B).

Disclaimer: The material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act (Cth) 2001 (Corporations Act) or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situations or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Privity Credit or any other person. To the maximum extent possible, Sandford Capital, Privity Credit or any other person do not accept any liability to any statement in this material. Privity Credit Pty Limited is a corporate authorised representative (CAR No. 1269259) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital).

3

Past performance

Secured, direct lending

Our selection process prioritises the strength of each opportunity and the diversity of borrowers, asset classes and industries in our portfolio. We also incorporate the prevailing credit and business environment into our decision making framework. By carefully selecting opportunities amongst Australia’s and New Zealand’s mid-market, conducting rigorous due diligence and then actively managing loans, we can create strong alignment with investor goals and robust risk management.

Closed

Privity Private IV

(formerly DCF Private Debt Fund IV)

Strategy

The Privity Private IV (formerly DCF Private Debt Fund IV) aims to deliver stable income through investing in direct medium‐term secured loans to quality corporate borrowers in the Australian and New Zealand mid-market. We have long term relationships with borrowers and their advisers which gives us an excellent pipeline of potential investments.

We carefully screen each loan, approving only the most compelling opportunities that meet our rigorous criteria. Our selection process prioritises the strength of each opportunity, the diversity of borrowers, asset classes and industries already in our portfolio, and the prevailing dynamics of the private credit market and broader business environment.

Fund overview

Opened

26 – Apr – 2021

Status

Active but closed for new investments

IRR

9.68% p.a. after fees since inception. As at 31 March 2025.

Closed

Privity Private III

(formerly DCF Private Debt Fund III)

Strategy

DCF Private Debt Fund III, now Privity Private III, was launched to continue to target the credit gap for corporate borrowers and was tailored for the wholesale investor marketplace.

The Fund was a closed-end unit trust offering investors an opportunity to gain access to the corporate credit market with strong investment returns to be delivered due to premium pricing achieved via a robust investment structure across a portfolio of diverse credit exposures.

Fund overview

Opened

30 – Nov – 2018

Status

Closed 22 – Dec – 2023

IRR

11.62% p.a. after fees since inception. As at closed date.

Closed

Privity Private II

(formerly DCF Private Debt Fund II)

Strategy

Privity Credit launched its second initiative, DCF Private Debt Fund II (now Privity Private II), in November 2015, which was institutionally backed by a major global fund manager, targeted at short-term event-driven finance solutions for SME and mid-market corporate borrowers.

Fund overview

Opened

Oct – 2015

Status

Closed Dec – 2017

IRR

12.50% p.a. after fees since inception. As at closed date.

Closed

Privity Private I

(formerly DCF Private Debt Fund I)

Strategy

Privity Credit launched its first initiative in 2013, DCF Private Debt Fund I (now called Privity Private I) by managing the origination and structuring of credit exposures. Privity Credit Fund I provided stretched senior facilities to SME and mid-market corporate borrowers, utilising credit enhancement provided via a -AA S&P rated insurance product. Privity Credit Fund I was institutionally backed by a major global bank.

Following the Global Financial Crisis (GFC), as valuations had been revised downwards and lending ratios had been materially paired back, Australian borrowers found themselves with a considerable credit gap in their capital structure. Privity Credit implemented this lending structure, via institutional investors, that reinstated lending levels to support borrowers while underwriting the risk position of investors.

Fund overview

Opened

Jan – 2013

Status

Closed Dec – 2014

IRR

9.50% p.a. after fees since inception. As at closed date.